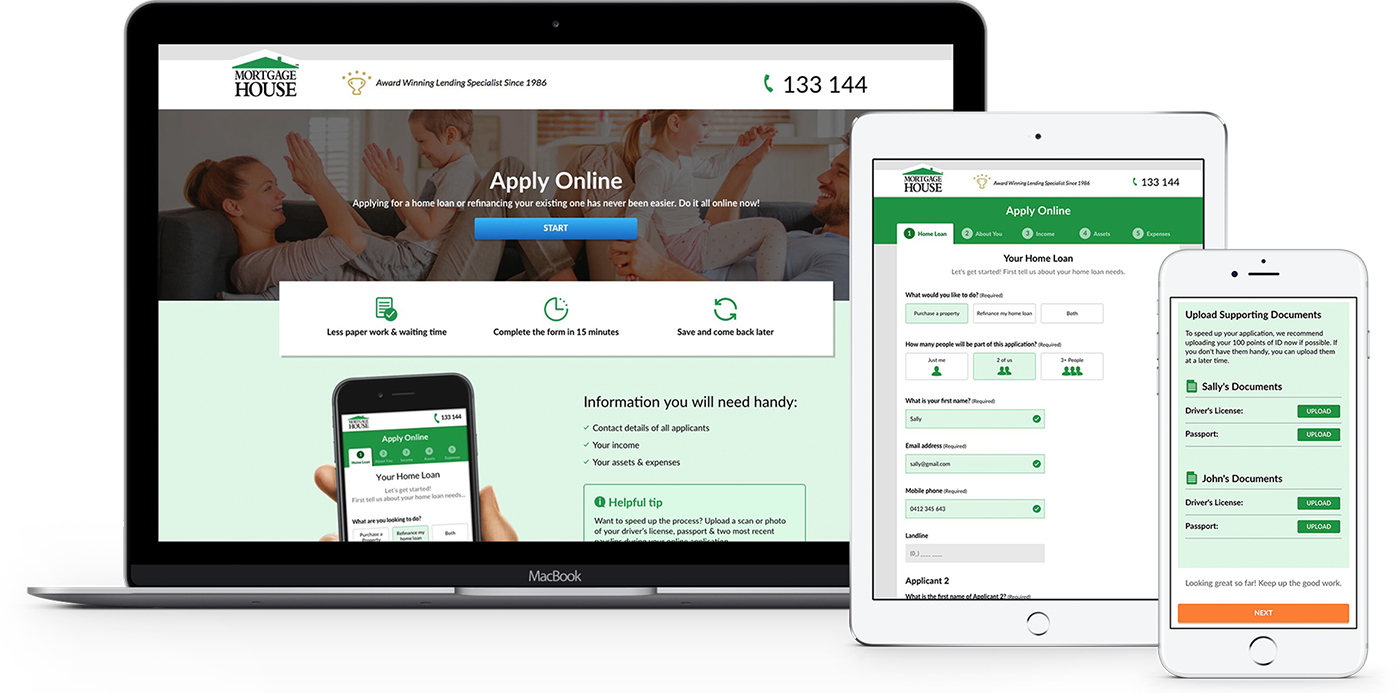

Rysen partnered with Mortgage House to improve the overall customer journey and user experience of an often complex process, by creating an industry leading online home loan application tool, simply called ‘Apply Online’.

The objective of Apply Online was to provide an easy to use, streamlined application form that keeps the user engaged. Apply Online allows the user to access and accurately complete the form anywhere at any time, enhancing the user experience and accelerating the loan application process for Mortgage House customers.

To achieve the objective, Rysen partnered with Mortgage House to deliver:

- In-depth customer, industry and competitor research and analysis.

- Intensive user experience workshops consisting of persona creation, empathy mapping and user journey mapping to identify customer pain points and opportunities to enhance the UX

- MVP mapping workshops to prioritise the web app features and functionality across multiple phases

- Thorough analysis of existing questions asked for a mortgage application to identify areas that could be streamlined or made more customer friendly

- High fidelity wireframes

- Wireframe prototyping and usability testing to identify any potential user issues and obstacles so they could be removed

The launch of Apply Online has resulted in significant improvements in the quality of applications submitted by customers and reduced turnaround times from days to hours. The key UX features and functionality contributing to the success of Mortgage House Apply Online include:

- Simplified and streamlined application process

- Ability for a user to access their application online, anywhere at anytime

- Fully responsive UX design and development compatible with all major browsers and devices

- Achieving efficiency through pre-populating fields based on previous data entered and predictive address search

- Conditional fields ensuring users are only asked relevant questions based on responses provided

- Providing a personalised experience by applying applicants first names to questions

- Customised progress messages to encourage users through the form

- Real time visual validation of customer inputs

- ‘Save and continue later’ functionality

- Integrating SMS code retrieval for returning users to ensure the highest data security

- Ability to upload key documents throughout the application

- Partnering with media specialists (Ultimate Edge Communications) to integrate with the Marketo email platform

- Developing a ‘Book a Call Back’ functionality allowing the user to control when a lending manager would call them

- Page speed and performance enhancements to ensure optimised user experience

Key development solutions used to create the optimised user experience included:

- Utilising the latest technology: Angular 4, Typescript, Node.JS, Jasmine, Karma, Webpack, MongoDB, SASS/SCSS & Bootstrap

- Meeting development standards through intensive unit tests and utilising the Angular style guide

- Confidentiality and online data security encryption

EXPERIENCE APPLY ONLINE